Stock Alpha

Title: Comprehensive Guide to Equity Research Meta Description: Discover the essentials of equity research, including methodologies, key metrics, and tips for effective analysis to enhance your investment decisions. Equity research is a critical component of investment analysis, providing insights into the financial health and potential growth of companies. This guide will explore the key aspects of equity research, helping investors make informed decisions. Understanding Equity Research Equity research involves analyzing a company's financial statements, market position, and industry trends to determine its stock value. Analysts use various methodologies, including fundamental analysis and technical analysis, to assess a company's performance. Key Metrics in Equity Research 1. Earnings Per Share (EPS): A vital indicator of a company's profitability. 2. Price-to-Earnings (P/E) Ratio: Helps investors evaluate the stock's valuation compared to its earnings. 3. Return on Equity (ROE): Measures a company's efficiency in generating profits from shareholders' equity. Effective Equity Research Techniques - Conduct thorough financial analysis: Review balance sheets, income statements, and cash flow statements. - Stay updated on market trends: Monitor economic indicators and industry news that may impact stock performance. - Utilize valuation models: Apply discounted cash flow (DCF) analysis and comparable company analysis to estimate fair value. Enhancing Your Research Process To improve your equity research, consider the following tips: - Create a structured approach: Organize your research into clear sections for better readability. - Use bullet points for clarity: Present key information in concise lists to enhance understanding. - Incorporate visuals: Graphs and charts can effectively illustrate trends and comparisons. Conclusion Equity research is essential for making informed investment decisions. By understanding key metrics and employing effective research techniques, investors can enhance their analysis and improve their chances of success in the stock market.

AI Project Details

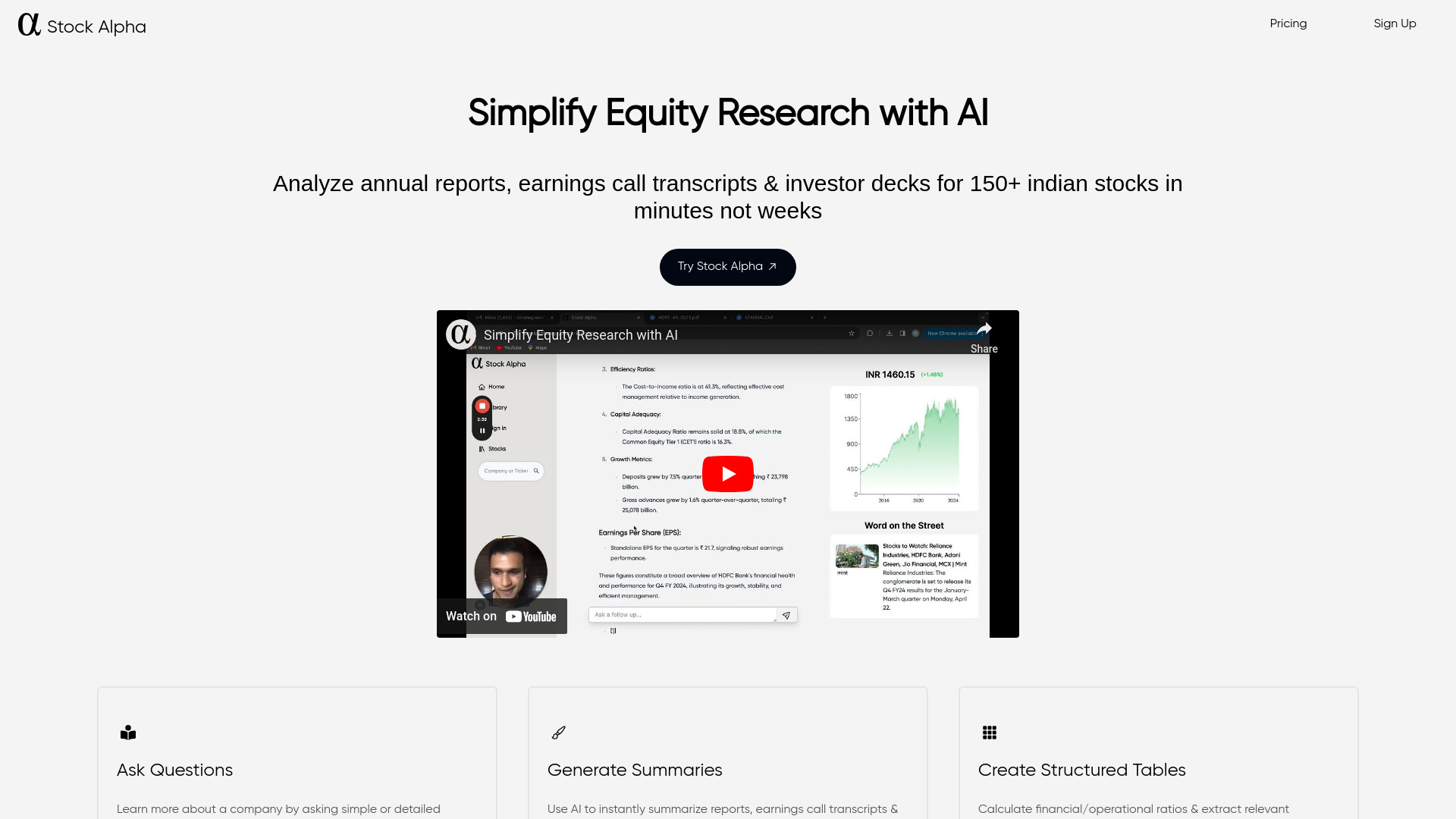

What is Stock Alpha?

Stock Alpha is an answer engine for equity research. It allows users to ask questions and create custom reports on annual reports, earnings calls, and investor presentations for over 100+ Indian stocks including the Nifty 50. It is designed to save weeks in research for professional analysts and retail investors.

How to use Stock Alpha?

Using Stock Alpha is easy. Simply log in, select the stocks you are interested in, and start asking questions or generating custom reports.

Stock Alpha's Core Features

- Custom report generation for annual reports, earnings calls, and investor presentations

- Time-saving tool for professional analysts and retail investors

Stock Alpha's Use Cases

- Analyze the effect of acquisitions on company performance

- Track changes in key financial metrics post-mergers

- Analyze company spending and portfolio breakdown

FAQ from Stock Alpha

Can I use Stock Alpha for stock analysis of companies outside India?

Is Stock Alpha suitable for beginner investors?

Stock Alpha Company

Stock Alpha Company name: Stock Alpha, Inc.

Stock Alpha Sign up

Stock Alpha Sign up Link: https://stockalpha.xyz/home?modal=true

Stock Alpha Pricing

Stock Alpha Pricing Link: https://stockalpha.xyz/pricing

Stock Alpha Youtube

Stock Alpha Youtube Link: https://youtube.com/@stockalphaxyz?si=boQPrFpXFIBow58u

Stock Alpha Linkedin

Stock Alpha Linkedin Link: TakeAI is your premier destination for discovering the best AI tools and applications. © 2026 TakeAI.org. All rights reservedProduct

Connect with us