trueaccord.com

Recovery and collections platform with machine learning

AI Project Details

TrueAccord: The AI-Powered Future of Debt Recovery and Collections

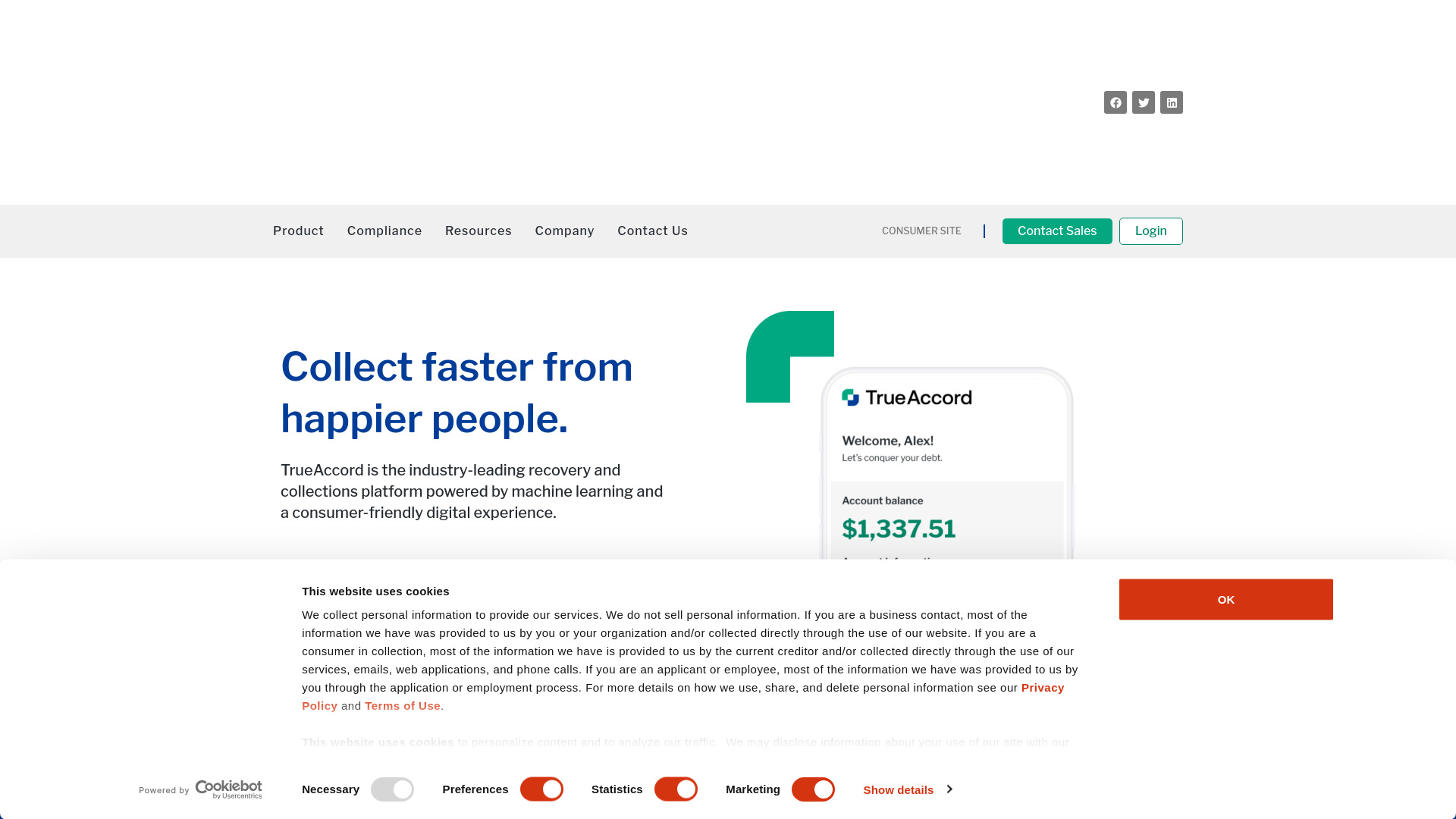

TrueAccord is a pioneer in the fintech space, offering a digital-first debt recovery and collections platform that replaces traditional, aggressive tactics with data-driven engagement. By leveraging advanced machine learning and behavioral analytics, TrueAccord transforms the delinquency management process into a compassionate, automated, and highly effective experience for both creditors and consumers.

Key Features of the TrueAccord Platform

- Heartbeat Machine Learning Engine: At the core of the platform is a sophisticated AI engine that analyzes consumer behavior in real-time. It determines the best time, channel, and messaging to reach an individual, ensuring higher engagement rates without the need for intrusive phone calls.

- Omnichannel Communication: TrueAccord meets consumers where they are. The platform utilizes a seamless mix of email, SMS, and digital notifications, allowing individuals to resolve their debts on their own terms using their preferred devices.

- Personalized Self-Service Portal: Consumers gain access to an intuitive, mobile-optimized portal where they can view their balance, negotiate settlements, and set up flexible payment plans that fit their specific financial situation.

- Robust Compliance and Security: Built with a focus on regulatory requirements, the platform ensures adherence to FDCPA, TCPA, and other consumer protection laws, significantly reducing legal risks for enterprises.

- Real-Time Analytics and Reporting: Creditors can monitor recovery performance through comprehensive dashboards, providing deep insights into liquidation rates and consumer engagement trends.

Strategic Benefits for Modern Businesses

In an era where brand reputation is paramount, TrueAccord offers a way to recover assets while maintaining positive customer relationships. By moving away from high-pressure call centers, businesses can significantly reduce their operational overhead while increasing their overall recovery ROI.

The platform’s AI-driven approach minimizes human error and ensures that every interaction is consistent, professional, and compliant. This results in a "retention-first" strategy, where customers who have fallen behind are treated with dignity, making them more likely to return as loyal clients once their financial health is restored.

Versatile Use Cases Across Industries

TrueAccord is designed to scale across various sectors that require efficient delinquency management, including:

- Financial Services and Banking: Managing credit card debt, personal loans, and overdrafts with a focus on long-term customer value.

- Fintech and Neobanks: Providing a digital-native solution that aligns with the expectations of tech-savvy users.

- E-commerce and Retail: Handling "Buy Now, Pay Later" (BNPL) delinquencies and store credit accounts through automated outreach.

- Utilities and Telecommunications: Streamlining the collection of past-due service bills without disrupting the essential services provided to customers.

Redefining Debt Collection with Technology

By integrating machine learning into the debt recovery lifecycle, TrueAccord bridges the gap between traditional collections and modern financial technology. It empowers consumers through transparency and flexibility while providing creditors with a scalable, high-performing solution for managing accounts receivable in a complex global economy.