AlgoVue

AlgoVue: The Ultimate No-Code Editor for Algorithmic Trading Are you looking to enhance your algorithmic trading experience without the need for complex coding? Look no further than AlgoVue, a powerful no-code editor designed specifically for algo trading. With its advanced features and integrated AI, AlgoVue empowers traders of all levels to create, test, and deploy trading algorithms effortlessly. Key Features of AlgoVue: Why Choose AlgoVue?

With AlgoVue, you can save time and reduce the complexity of algorithmic trading. Whether you are a seasoned trader or just starting, our platform provides the resources you need to succeed. Experience the future of trading with AlgoVue, where innovation meets simplicity. Start your journey in algorithmic trading today with AlgoVue and unlock the potential of no-code trading solutions!

Category:code-it ai-app-builder

Create At:2024-12-15

AlgoVue AI Project Details

What is AlgoVue?

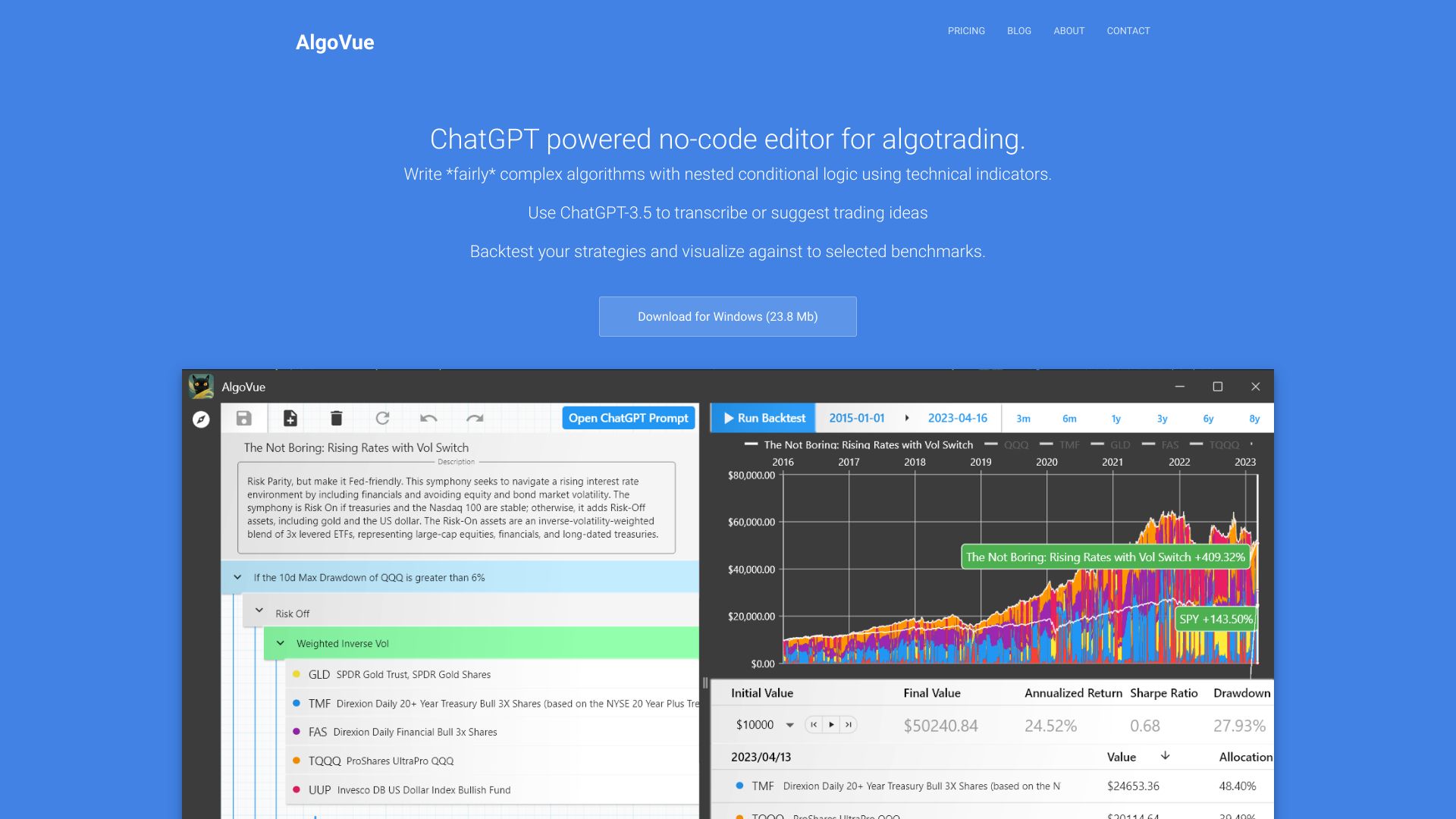

AlgoVue is a no-code editor for algo trading that allows users to create fairly complex algorithms with nested conditional logic using technical indicators. It integrates ChatGPT-3.5 for transcribing or suggesting trading ideas, and offers backtesting and visualization capabilities against selected benchmarks.

How to use AlgoVue?

To use AlgoVue, simply download the desktop app for Windows. The intuitive and user-friendly interface allows you to create algorithms using technical indicators and nested conditional logic. You can also leverage the power of ChatGPT-3.5 for transcription and idea generation. Backtest your strategies and visualize their performance against benchmarks. AlgoVue's no-code visual editor enables you to write complex nested logic effortlessly, and you can export your algorithms as Backtrader.py Python or TradingView Pine Script.

AlgoVue's Core Features

- No-code visual editor for algo trading

- Nested conditional logic with technical indicators

- Transcription and idea suggestion using ChatGPT-3.5

- Backtesting and visualization against benchmarks

- Export algorithms as Backtrader.py Python or TradingView Pine Script

AlgoVue's Use Cases

- Portfolio rebalancing

- Pairs trading

- Buying the dip

- Asset allocation by percentage or inverse volatility

FAQ from AlgoVue

What is AlgoVue?

How do I use AlgoVue?

What are the core features of AlgoVue?

What are the use cases for AlgoVue?

AlgoVue Support

For support, please contact us via email or visit our contact us page.